Looking for care in your area? Baylor Scott & White Health Plan's online search tool helps you locate doctors, hospitals, pharmacies and more.

Pharmacy/formulary search

Access details on your plan's prescription drug network:

Tools

We invite Baylor Scott & White Health Plan members to learn more about how you can use your coverage to access the services you need, when you need them.

*Request a credit toward your PPO deductible and annual maximum out-of-pocket expenses.

Portal

For Medicare Advantage, Marketplace and Employer Group members.

Your one-stop shop for most information and questions. With our 24/7 member portal, you can enjoy access to your health plan within a secure environment that includes resources you can count on from Baylor Scott & White Health Plan.

Nurse Advice Line

Need care advice? Do you have health or medication questions? For non-emergency symptoms and health or treatment questions, members can call the 24-Hour Nurseline to speak with a registered nurse.

If you speak another language, our Customer Service representatives can connect you with an interpreter. You can also get information in larger print or in any other language format, if needed. Our TTY line is 711.

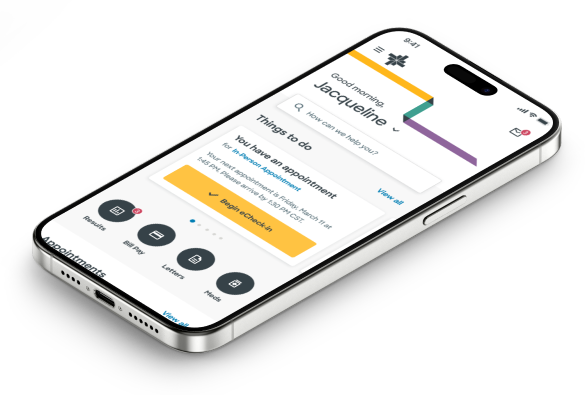

MyBSWHealth app

MyBSWHealth offers virtual care whenever and wherever you need it. Like right now. Or later tonight. Or even on Sunday. To get the care you need now, simply download the app.

More Resources

-

Your member ID card

Remember to carry your Baylor Scott & White Health Plan member ID card with you at all times. You will need to show it to your provider(s) when you receive covered services. Your card contains important information, including your plan name, member ID number, copay/coinsurance amounts and customer service phone numbers to call if you have questions.

You can also contact our Customer Service team and request your new card be mailed to you.

NOTE: Information shown on your ID card may vary based on your plan benefits.

-

Helpful links

-

Forms

- Authorization to release protected health information (PHI)

- Authorization to release protected health information (PHI)

- Appointment of a representative form (Medicare only)

- Covenant Health Advantage claim form

- Instructions to authorize release of information

- Instructions to authorize release of information

-

Health insurance explained

Health insurance can be confusing, so we've compiled some resources to help you understand your plan and ask the right questions about your coverage.

Community Resources

Access valuable healthcare programs and event information, including support groups, educational sessions, volunteer opportunities and more available throughout the communities we serve.

-

Hospital-based resources

- Abilene-area resources (Hendrick Health)

- Lubbock-area resources (Covenant Health)

- BSW-area resources (Baylor Scott & White)

-

Advance life planning

- CaringInfo.org: Educational information and forms for living wills and durable power of attorney for healthcare

- State of Texas advance directive forms

- Palliative care information

-

Child & teen health

- Car seat resources (South Plains)

- Car seat resources (All of Texas; Safe Riders)

- Children with Special Healthcare Needs (CSHCN) services program

- Early Childhood Intervention Program: State of Texas support for children with developmental delays

- Support for families with babies in neonatal intensive care units (NICU)

- WebMD teen channel

- WebMD health & parenting resources

- GoNoodle Movement & mindfulness videos

- Women, Infants & Children (WIC) Program: State of Texas program providing nutrition support link

-

Dental health

- FreeDentalCare: Online list of free or reduced-price dental care providers

-

Disability resources

- Texas Ramp Project

- Maid Service: Nonprofit organization offering free house cleaning to women undergoing treatment for any type of cancer

- Personal Care Services

-

Elderly, aging & senior resources

-

Women's health

- Healthy Texas Women: Supported by Texas Health and Human Services

-

Miscellaneous information & resources

- findhelp: National directory of support services across the USA.

- 211.org: National directory of support services across the USA supported by United Way

- Texas Emergency Broadband Benefit Program: The Federal Communications Commission is offering an Emergency Broadband Benefit

- yesquit.org: Help yourself quit smoking.

- Easy-to-read health materials

- RightCare member benefits

Mandatory Disclosures

For BSWHP HMO/EPO/PPO members, where applicable.

-

Provider network access plan for members

Your BSWHP plan includes access to a network of providers (i.e., doctors, hospitals, other healthcare providers, etc.) to meet your healthcare needs. These providers are contracted with us and are considered "in-network." They are available to you for a full range of covered healthcare services. This plan provides insight to the process we use to develop and maintain adequate provider access.

HMO plan descriptions

-

Notice of special toll-free complaint number

To make a complaint about a private psychiatric hospital, chemical dependency treatment center or psychiatric or chemical dependency services at a general hospital, call: 800.832.9623 Your complaint will be referred to the state agency that regulates the hospital or chemical dependency treatment center.

-

Telemedicine medical services & telehealth services

Any contracted BSWHP provider can provide telemedicine medical services and/or telehealth services, for certain circumstances and conditions, to a BSWHP member.

- No pre-authorization is required by an in-network BSWHP provider. However, if an out-of-network provider is needed, pre-authorization is required. In these cases, BSWHP requires a 48-hour advance notice prior to the member receiving telemedicine services from an out-of-network provider.

- Covered services are subject to all applicable copayments, coinsurance and deductible amounts, not exceeding those for the same covered service provided in an in-person location such as a doctor's office, clinic or hospital.

If you have any questions, contact the Plan Customer Service at the number on the back of your BSWHP member ID card.

BSWHP is a State of Texas not-for-profit company, organized for the purpose of operating an Independent Practice Association (IPA)-model health maintenance organization. BSWHP provides prepaid medical, hospital and related comprehensive healthcare services to HMO subscribers and their enrolled dependents within our approved service area.

BSWHP does not employ incentives to encourage barriers to care and services, specifically reward practitioners or other individuals conducting utilization review for issuing denials of coverage or service care, or provide incentives for utilization review decision makers that result in underutilization. Utilization management decision-making is based only on the appropriateness of care and service and the existence of coverage.

Health Maintenance Organization (HMO) products are offered through Scott and White Health Plan dba Baylor Scott & White Health Plan, and Scott & White Care Plans dba Baylor Scott & White Care Plan. Insured PPO and EPO products are offered through Baylor Scott & White Insurance Company. Scott and White Health Plan dba Baylor Scott & White Health Plan serves as a third-party administrator for self-funded employer-sponsored plans. Baylor Scott & White Care Plan and Baylor Scott & White Insurance Company are wholly owned subsidiaries of Scott and White Health Plan. These companies are referred to collectively in this document as Baylor Scott & White Health Plan.

-

Your rights & protections against surprise medical bills

When you get emergency care or get treated by an out-of-network provider at an in-network hospital or ambulatory surgical center, you are protected from surprise billing or balance billing.

What is "balance billing" (sometimes called "surprise billing")?

When you see a doctor or other healthcare provider, you may owe certain out-of-pocket costs, such as a copayment, coinsurance and/or a deductible. You may have other costs or have to pay the entire bill if you see a provider or visit a healthcare facility that isn't in your health plan's network.

"Out-of-network" describes providers and facilities that haven't signed a contract with your health plan. Out-of-network providers may be permitted to bill you for the difference between what your plan agreed to pay and the full amount charged for a service. This is called "balance billing." This amount is likely more than in-network costs for the same service and might not count toward your annual out-of-pocket limit.

"Surprise billing" is an unexpected balance bill. This can happen when you can't control who is involved in your care—like when you have an emergency or when you schedule a visit at an in-network facility but are unexpectedly treated by an out-of-network provider.

You are protected from balance billing for:

Emergency services

If you have an emergency medical condition and get emergency services from an out-of-network provider or facility, the most the provider or facility may bill you is your plan's in-network cost-sharing amount (such as copayments and coinsurance). You can't be balance billed for these emergency services. This includes services you may get after you're in stable condition unless you give written consent and give up your protections not to be balanced billed for these post-stabilization services.

Certain services at an in-network hospital or ambulatory surgical center

When you get services from an in-network hospital or ambulatory surgical center, certain providers there may be out-of-network. In these cases, the most those providers may bill you is your plan's in-network cost-sharing amount. This applies to emergency medicine, anesthesia, pathology, radiology, laboratory, neonatology, assistant surgeon, hospitalist or intensivist services. These providers can't balance bill you and may not ask you to give up your protections not to be balance billed.

If you get other services at these in-network facilities, out-of-network providers can't balance bill you, unless you give written consent and give up your protections.

You're never required to give up your protections from balance billing. You also aren't required to get care out-of-network. You can choose a provider or facility in your plan's network.

When balance billing isn't allowed, you also have the following protections:

- You are only responsible for paying your share of the cost (like the copayments, coinsurance, and deductibles that you would pay if the provider or facility was in-network). Your health plan will pay out-of-network providers and facilities directly.

- Your health plan generally must:

- Cover emergency services without requiring you to get approval for services in advance (prior authorization).

- Cover emergency services by out-of-network providers.

- Base what you owe the provider or facility (cost-sharing) on what it would pay an in-network provider or facility and show that amount in your explanation of benefits.

- Count any amount you pay for emergency services or out-of-network services toward your deductible and out-of-pocket limit.

If you believe you've been wrongly billed, you may contact the No Surprises Helpdesk at 800.985.3059.

Visit cms.gov./nosurprises for more information about your rights under federal law.

Prior authorization

Prior authorization (sometimes referred to as pre-certification or pre-notification) determines whether non-emergent medical treatment is medically necessary, is compatible with the diagnosis, member benefits, and if the requested services are to be provided in the appropriate setting.

Prior authorization DOES NOT guarantee payment. Even if a Provider obtained the required prior authorization, Baylor must still process a provider’s claim to determine if payment will be made. The claim is processed according to:

- Eligibility

- Contract limitations

- Benefit coverage guidelines

- Applicable state or federal requirements

- National Correct Coding Initiative (NCCI) edits

- Texas Medicaid provider procedures manual (TMPPM)

- Other program requirements, as applicable

Medical prior authorization requests

-

Essential information

Providers must submit the prior authorization request form. The form must include the following information to initiate the prior authorization review process:

- Member:

- Name

- Date of birth

- Number

- Requesting provider:

- Name

- National Provider Identifier (NPI)

- Dated signature

- Rendering provider:

- Name

- NPI

- Tax ID

- Group NPI (if applicable)

- Service requested:

- Current Procedural Terminology (CPT)

- Healthcare Common Procedure Coding System (HCPCS)

- Current Dental Terminology (CDT)

- Start and end date(s)

- Quantity of service units requested based on the CPT, HCPCS or CDT requested

Please note any prior authorization requests missing essential information will not be processed and a new request will need to be submitted. To avoid delays in authorization or administrative denials, Providers are encouraged to submit sufficient documentation to validate the medical necessity for the services being requested. This may include, current progress notes, history and physical, radiology or laboratory results, consult notes/reports, treatment plans showing progress to goals (e.g. therapy requests), or similar medical record documentation to illustrate medical necessity.

For information regarding prior authorization submission process for drugs obtained under the MEDICAL benefit, refer to medical authorization requests.

For information regarding prior authorization submission process for drugs obtained under the PHARMACY benefit, refer to drug requests - prior authorizations, exceptions and appeals.

- Member:

-

Supporting clinical documentation

NCQA accreditation

Baylor Scott & White Health Plan has received accreditation from the National Committee for Quality Assurance (NCQA). This means that Baylor Scott & White Health Plan's service and clinical quality meet the basic requirements of NCQA's rigorous standards for consumer protection and quality improvement. Consumers can easily access organizations' NCQA statuses and other information on healthcare quality by visiting ncqa.org or calling NCQA Customer Support at 888.275.7585.