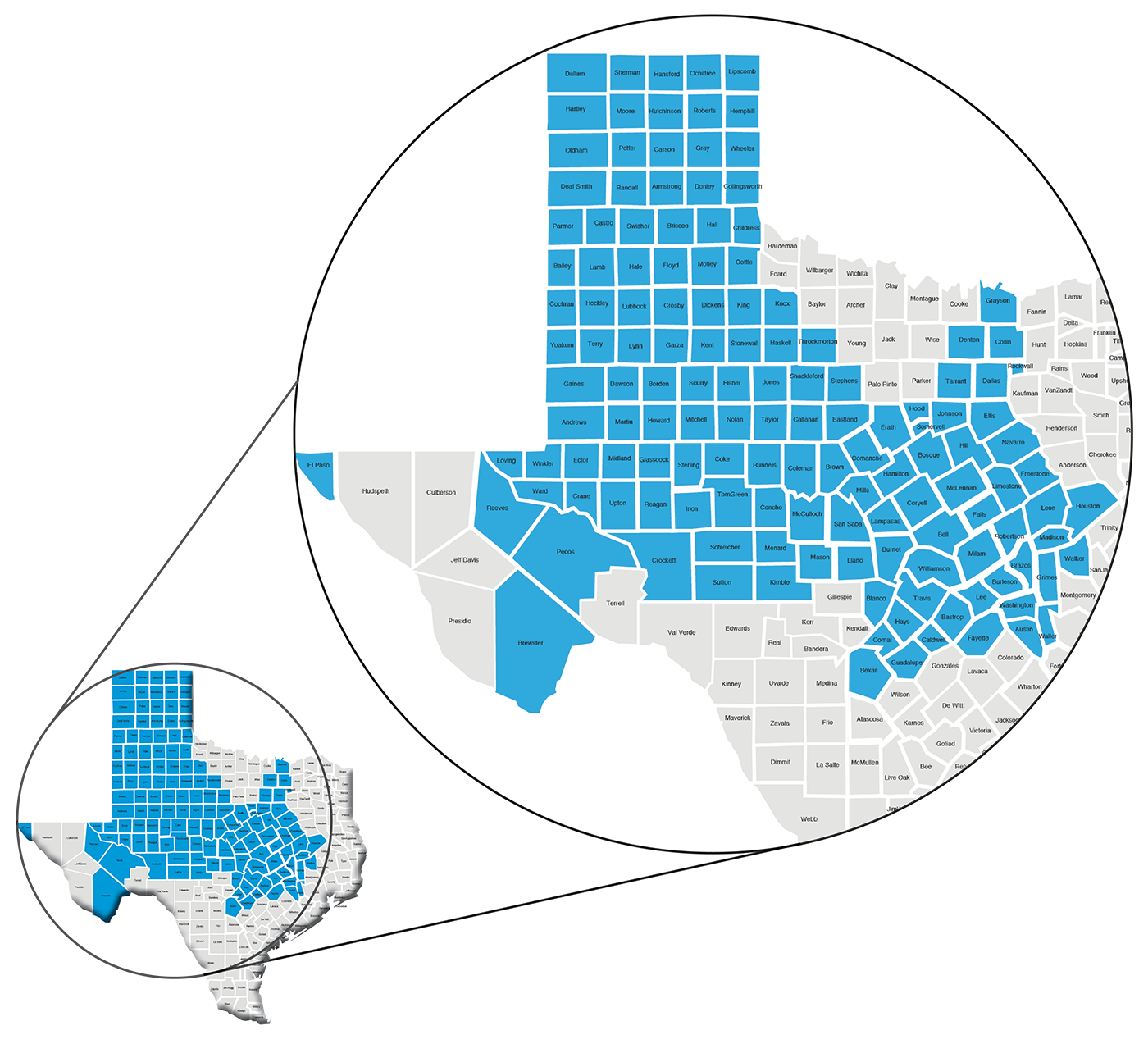

Whether you're a small, medium or large business, we have a plan for you. If your organization is headquartered in our 141-county service area, we are uniquely set up to help you and your employees get the most out of your healthcare coverage.

You'll enjoy affordable in-network access to the world-renowned doctors and hospitals of Baylor Scott & White Health as well as other providers across the state.

We are here to support you with the expertise and programs you need for your company to thrive. Because healthy employees are happy employees.

Small Group plans

(Companies with 2-50 employees)

Our small group plans offer big benefits. With more than 100 plans to choose from, we can help you find the right fit for you and your employees. We offer HMO, PPO and high-deductible health plans. Whichever plan or benefit level you choose, know that your employees' health will be in good hands.

-

Small Group plans include

- A vast network of local providers through Baylor Scott & White Health and thousands of other providers throughout Texas

- Plan options with no deductibles

- Prescription drug coverage

- Vision and eyewear benefits

- Virtual care

- Wellness programs

- Specialists visits with no referral

- No pre-existing condition restrictions

- No claim form submissions needed

-

Other benefits

- Dental

- Life and disability

- Health Savings Accounts (HSA)

Gold

With our Marketplace Gold plans, you have low or no deductibles and members will pay the lowest out-of-pocket costs for covered services.

Silver

With our Marketplace Silver Plans, you'll pay lower premiums than our Gold Plans. Deductibles may be as low as $0, and copayments for doctor visits or medications may be as low as $5.

Bronze

The Bronze Plans are our most affordable Marketplace plans. With a Bronze Plan, you will pay lower premiums with slightly higher out-of-pocket costs.

Large Group plans

(Companies with 51+ employees)

With a variety of networks, hundreds of plans and multiple prescription plan options, we have large groups covered. Each group is assigned an account management team that works with the group to support the benefits administrator, encourage participation in programs that reduce costs and share best practices for a successful program.

We offer HMO and PPO options, which include high-deductible health plans.

-

Large Group plans include

- Virtual care

- Wellness programs

- A vast network of local providers through Baylor Scott & White Health and thousands of other providers throughout Texas

- Plan options with no deductibles

- Prescription drug options

- Specialists visits with no referral

- No pre-existing condition restrictions

- No claim form submissions needed

-

Other benefits

- Dental

- Vision

- Life and disability

- Health Savings Accounts (HSA)

-

Customized features & programs

Expanded wellness offerings:

- On-site educational programs (when available)

- Biometric screenings (additional fees may apply)

- Online webinars

- Health plan participation in enrollment meetings*

- Custom member materials*

- An implementation team to ensure a smooth transition

- Additional funding arrangements available

*Dependent on group size and participation.

Administrative Services

Let us handle that for you

Self-funding can be a cost-effective alternative for many businesses. We offer experienced, professional contract administration and local, accurate adjudication of medical claims.

Baylor Scott & White Health Plan Administrative Services provides:

- Detailed design and administration of your customized benefit plan

- Responsive and friendly Texas-based customer service

- Accurate adjudication of medical claims

- Reporting, when you need it

- Access to multiple reinsurance carriers to provide excess loss protections for high-dollar claims

- Pharmacy benefits

SteadyFund level funded products

Funding solutions for small- & mid-size nusinesses

SteadyFund is a level-funded approach that helps businesses with as few as 20 employees enjoy the flexibility of engineering their own plan while keeping healthcare expenses predictable.

The group pays a fixed dollar amount each month, regardless of actual claims. When claims exceed that fixed amount, stop-loss coverage kicks in to cover the extra cost. That means the group will never pay more than their set maximum monthly payment per employee.

Accountable Care Organization

Offering the best of both worlds, BSW Premier HMO combines our high-efficiency Accountable Care Organization (ACO) network models with our broader service area. BSW Premier members have in-network options for care in 141 counties, with additional rate discounts offered in multiple counties in North, Central and West Texas.

How is that possible? We teamed up with Baylor Scott & White Quality Alliance (BSWQA) — the accountable care organization affiliated with Baylor Scott & White Health — and Covenant Health. Together, we created an integrated health solution that combines care, coverage and technology.

BSW Premier is more than just a health plan. It's a unique blend of doctors, hospitals, and an insurance plan, all coming together to better engage members in managing their health. Doctors who are part of the ACOs offered through Baylor Scott & White Quality Alliance and Covenant Health are held accountable for achieving specific quality, patient satisfaction and cost measures. By combining all aspects of health, BSW Premier delivers care and payment more efficiently, offering employers and employees a higher quality care experience at a lower cost.

The result: Members receive the most comprehensive, compassionate and cost-effective care possible.

To get the most out of care coordination, we encourage BSW Premier members to establish a relationship with a primary care physician (PCP) and continue to see them for care. However, members are not required to select or register with a PCP and do not need a referral to see an in-network specialist.