Enrollment/resources

Plan information

Award-winning Medicare Advantage plans

Baylor Scott & White Health Plan offers HMO-POS and PPO Medicare Advantage plans Texans trust. Our top priority is your health, that's why our BSW SeniorCare Advantage plans are designed to coordinate your doctors, simplify your experience and eliminate unnecessary expenses. Plans are available with or without prescription drug coverage and start as low as $0 per month.

As a patient of Baylor Scott & White Health and a member of a BSW SeniorCare Advantage plan, you can access healthcare and insurance information in one secure portal through the MyBSWHealth app or website — schedule appointments, message a provider, visit test results and review and pay bills.

Medicare star ratings

Every year, Medicare evaluates plans based on a 5-star rating system.

Medicare basics

Medicare is a national social insurance program administered by the US federal government. It guarantees access to health insurance for Americans ages 65 years old and older, people with disabilities and people with End-Stage Renal Disease (ESRD).

Overview of Medicare parts

Medicare has four parts: A, B, C and D. Each is designed to cover specific services based on different healthcare needs and budgets.

Part A

(Original Medicare)

Partial coverage for:

- Inpatient hospital

- Skilled nursing facility

- Home healthcare

Part B

(Original Medicare)

Partial coverage for:

- Primary care physician visits

- Outpatient surgery

- Lab services

- Durable medical equipment

Part C

(Medicare Advantage offered through BSW SeniorCare Advantage)

Similar to and takes the place of parts A and B with predictable out-of-pocket costs and more coverage. Including:

- Routine hearing benefits

- Routine vision benefits

- Dental benefits

- Fitness benefits

- Over-the-Counter benefits

Part D

(Medicare prescription drug coverage)

- Coverage for prescription drugs beyond what is covered by original Medicare.

- Our plans are available with or without Part D coverage.

- For 2026, maximum out-of-pocket amount is $2,100.

What to consider

Your Medicare Healthcare plan should meet your needs

There are a number of factors to consider when choosing a Medicare plan for the first time or changing your Medicare plan.

If you have current health or prescription drug coverage, get a clear understanding of how it works with Medicare. If you're covered through your employer, Indian Health or Tribal Health Program, talk to your benefits administrator or insurer before making any changes in your plan.

When you're ready to enroll in a new Medicare coverage plan, you can do so during designated enrollment periods.

Are you eligible to enroll in a Medicare Advantage plan?

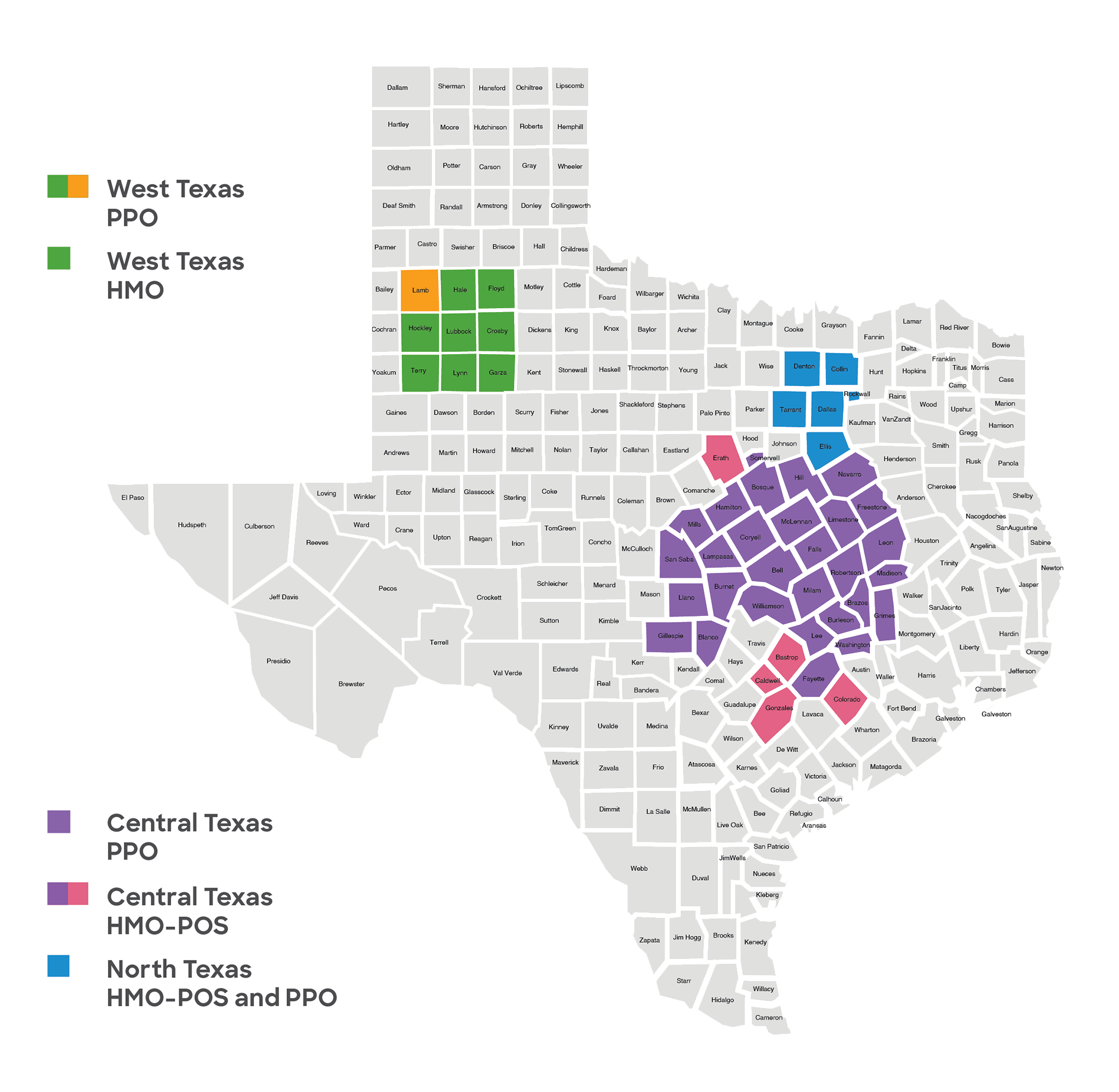

This guide shows you the Medicare Advantage plans offered by Baylor Scott & White Health Plan in North, Central and West Texas. Plans vary by region, and you must live in the county where the plan is offered to be eligible to enroll in the plan. Also:

- You must be enrolled in Medicare Part B.

- You must be entitled to benefits under Medicare Part A. If you do not have Medicare Part A, you can purchase it from Social Security

Don't miss your important enrollment dates

![]()

Annual enrollment period begins

If you're ready to enroll in a new plan or change your existing one, this is the first day you can sign up for coverage.

![]()

Annual enrollment period ends

This is the last day to sign up for a new plan or change your existing one until the next Annual Enrollment Period.

![]()

Your new plan begins

Relax and enjoy the peace of mind that comes with having the Medicare Advantage plan coverage you need.

Turning 65?

There is a 7-month window during the calendar year that you turn 65 in which you can enroll in Medicare. You are eligible to enroll in Medicare for the first time during the three months leading up to your 65th birthday, your birthday month and the three months afterward. This timeframe is called your Initial Enrollment Period or IEP.

![]()

3 months before your 65th birthday

![]()

The month of your 65th birthday

![]()

3 months after your 65th birthday

Avoid the penalties.

You might have to pay penalty fees if you do not enroll in Part A, Part B or Part D coverage on time.

Call a licensed insurance agent.

Learn how to avoid these fees and make your Medicare Advantage experience as seamless as possible. Contact a Medicare Advisor by calling 800.782.5068 (TTY: 711).

When choosing any healthcare plan, ask yourself:

- Are you in good health?

- How often do you see your doctor?

- Do you take prescription drugs?

- How much can you afford each month?

- Are you willing to change doctors if it means lower healthcare costs?

Medical costs

- How much are your premiums, deductibles and other costs?

- How much do you pay for services like hospital stays or doctor visits?

- Is there a yearly limit on what you could pay out of pocket for medical services?

Prescription costs

- Do you currently have prescription drug coverage?

- Will you pay a penalty if you join a drug plan later?

- What will your prescription drugs cost under each plan?

- Are your drugs covered under the plan's formulary?

- Are there any coverage rules that apply to your prescriptions?

- Is your pharmacy in the plan's network?

Medical care

- Do your doctors accept the coverage?

- Are the doctors you want to see accepting new patients?

- Do you have to choose your hospital and healthcare providers from a network?

- Do you need to get referrals?

- Are you satisfied with your medical care?

Budget-friendly benefits to keep you healthy

Most plans include:

- $0 to low monthly premium and $0 medical deductible

- $0 primary care visits

- $0 virtual care

- $0 dental premium

- $0 routine vision and hearing coverage, with eyewear and hearing aid allowances

- $0 fitness membership

- $0 over-the-counter card ($30-$130 per quarter)

- Prescription drug coverage included on most plans:

- $0 copay on select preferred retail and mail-order prescription drugs.

- Plus, get a 3-month supply of mail-order prescriptions for the cost of 2 months on Drugs on Tier 3.

- $0 routine transportation and in-home meals on most plans

- And more!

Bonus benefits & additional care programs

Kidney Care Program

BSW Care Managers can help you with appointments, medications, understanding your kidney care plan and more.

844.279.7589

7 AM to 9 PM weekdays

9 AM to 7 PM weekends

*Central Texas and North Texas only

More details are available on our member resources page.

Texas-sized Customer Service

Have questions, or want a little extra assistance? Give us a call.

7 AM to 8 PM daily7 AM to 8 PM weekdays (closed major holidays)

Baylor Scott & White Health Plan

1206 W. Campus Drive

Temple, TX 76502

Baylor Scott & White Health Plan offers BSW SeniorCare Advantage HMO-POS plans as a Medicare Advantage (MA) organization through a contract with Medicare. Baylor Scott & White Insurance Company offers BSW SeniorCare Advantage PPO plans as an MA organization through a contract with Medicare. Enrollment in one of these plans depends on the health plan's contract renewal with Medicare.

Y0058_BSWHPWEBSITE2026_C CMS 10/1/2025 | Last updated: 1/1/26